New posts will be delivered only @ our new webpage @ http://thesamadhi.com

SPX × USD/JPY

Since short term focus is about stimulating the world financial system, I am expecting short term bull on global equity market. Longer term of global stock market will be decided by steps taken in meeting for more regulations.

These are USDJPY & S&P500 comparative charts.

S&P 500 daily channel pattern is very simmilar to current USDJPY daily channel pattern.

S&P 500 daily channel pattern is very simmilar to current USDJPY daily channel pattern.Therefore, if the pattern is right on bear side than will see USDJPY near 85 and S&P500 in lower 800's.

But if, USDJPY goes back to correction bull side on upper channel line in it's 105 level, then will surely see S&P 500 to 1100 level.

Many Wall Streeters have predicted that we have hit the bottom on S&P500 & many are saying that worst is yet to come, but I am still expecting more strenghning of JPY over the long run, because demand of Japanese Exports has slowed down tremendously .

Now, let's look @ short term charts of these two pairs.

Short Term charts are clearly showing bullish chart patterns. And we also know that expansion of credits will rally the market for shorter term. Recently China pumped money into system; interest rates are being lowered in G20 nations rapidly; World Bank is also pumping money. The key thing will be to know what decisions are being taken ub November 14th meeting other than pumping money into system.

Short Term charts are clearly showing bullish chart patterns. And we also know that expansion of credits will rally the market for shorter term. Recently China pumped money into system; interest rates are being lowered in G20 nations rapidly; World Bank is also pumping money. The key thing will be to know what decisions are being taken ub November 14th meeting other than pumping money into system.

Credits × ECB × Fed × Trading Economics × US Politics

Bailouts × Banks × Ben Bernanke × Peter Schiff × US Economy

Part 2

Bailouts × Banks × Fed × US Dollar × US Economy × US Financials × US Treasury × Volatility

Fed × Fed Fund Target Rate × US Dollar × Volatility

Fed Fund Target Rate 1 year

Fed Fund Target Rate 5 months

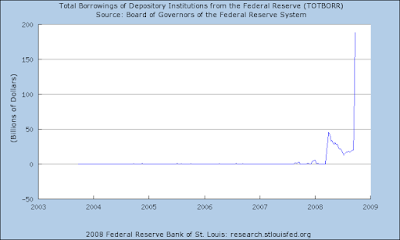

Source: St. Louis Fed

Source: St. Louis Fed

AIG × Bailouts × Banks × Ben Bernanke × CNBC × Commodities × Credits × Fed × FRE × Geo Politics × US Dollar × US Economy × US Financials × US House of Representatives × US Politics × US Treasury

Via Bloomberg.....

Via Bloomberg.....

AIG × Alan Greenspan × US Dollar × US Economy × US Financials × US House of Representatives × US Politics × US Treasury × US$ Index

Bail Outs × Bailouts × Banks × US Dollar × US Economy × US House of Representatives × US Politics × US Treasury

Bailouts × Banks × US Dollar × US Economy × US Financials × US Politics × US Treasury

Fed × US Dollar × US Economy × US Financials × US Politics × US Treasury × US$ Index

Bail Outs × Peter Schiff × US Dollar × US Economy × US Financials × US Politics × US Treasury × US$ Index

Bernie Sanders × CNBC × Kudlow

Bail Outs × Bailouts × US Dollar × US Economy × US Financials × US Politics × US Treasury

To the Speaker of the House of Representatives and the President pro tempore of the Senate:

As economists, we want to express to Congress our great concern for the plan proposed by Treasury Secretary Paulson to deal with the financial crisis. We are well aware of the difficulty of the current financial situation and we agree with the need for bold action to ensure that the financial system continues to function. We see three fatal pitfalls in the currently proposed plan:

1) Its fairness. The plan is a subsidy to investors at taxpayers’ expense. Investors who took risks to earn profits must also bear the losses. Not every business failure carries systemic risk. The government can ensure a well-functioning financial industry, able to make new loans to creditworthy borrowers, without bailing out particular investors and institutions whose choices proved unwise.

2) Its ambiguity. Neither the mission of the new agency nor its oversight are clear. If taxpayers are to buy illiquid and opaque assets from troubled sellers, the terms, occasions, and methods of such purchases must be crystal clear ahead of time and carefully monitored afterwards.

3) Its long-term effects. If the plan is enacted, its effects will be with us for a generation. For all their recent troubles, America's dynamic and innovative private capital markets have brought the nation unparalleled prosperity. Fundamentally weakening those markets in order to calm short-run disruptions is desperately short-sighted.

For these reasons we ask Congress not to rush, to hold appropriate hearings, and to carefully consider the right course of action, and to wisely determine the future of the financial industry and the U.S. economy for years to come.

Signed (updated at 9/25/2008 8:30AM CT)

Acemoglu Daron (Massachussets Institute of Technology)

Adler Michael (Columbia University)

Admati Anat R. (Stanford University)

Alexis Marcus (Northwestern University)

Alvarez Fernando (University of Chicago)

Andersen Torben (Northwestern University)

Baliga Sandeep (Northwestern University)

Banerjee Abhijit V. (Massachussets Institute of Technology)

Barankay Iwan (University of Pennsylvania)

Barry Brian (University of Chicago)

Bartkus James R. (Xavier University of Louisiana)

Becker Charles M. (Duke University)

Becker Robert A. (Indiana University)

Beim David (Columbia University)

Berk Jonathan (Stanford University)

Bisin Alberto (New York University)

Bittlingmayer George (University of Kansas)

Boldrin Michele (Washington University)

Brooks Taggert J. (University of Wisconsin)

Brynjolfsson Erik (Massachusetts Institute of Technology)

Buera Francisco J. (UCLA)

Camp Mary Elizabeth (Indiana University)

Carmel Jonathan (University of Michigan)

Carroll Christopher (Johns Hopkins University)

Cassar Gavin (University of Pennsylvania)

Chaney Thomas (University of Chicago)

Chari Varadarajan V. (University of Minnesota)

Chauvin Keith W. (University of Kansas)

Chintagunta Pradeep K. (University of Chicago)

Christiano Lawrence J. (Northwestern University)

Cochrane John (University of Chicago)

Coleman John (Duke University)

Constantinides George M. (University of Chicago)

Crain Robert (UC Berkeley)

Culp Christopher (University of Chicago)

Da Zhi (University of Notre Dame)

Davis Morris (University of Wisconsin)

De Marzo Peter (Stanford University)

Dubé Jean-Pierre H. (University of Chicago)

Edlin Aaron (UC Berkeley)

Eichenbaum Martin (Northwestern University)

Ely Jeffrey (Northwestern University)

Eraslan Hülya K. K.(Johns Hopkins University)

Faulhaber Gerald (University of Pennsylvania)

Feldmann Sven (University of Melbourne)

Fernandez-Villaverde Jesus (University of Pennsylvania)

Fohlin Caroline (Johns Hopkins University)

Fox Jeremy T. (University of Chicago)

Frank Murray Z.(University of Minnesota)

Frenzen Jonathan (University of Chicago)

Fuchs William (University of Chicago)

Fudenberg Drew (Harvard University)

Gabaix Xavier (New York University)

Gao Paul (Notre Dame University)

Garicano Luis (University of Chicago)

Gerakos Joseph J. (University of Chicago)

Gibbs Michael (University of Chicago)

Glomm Gerhard (Indiana University)

Goettler Ron (University of Chicago)

Goldin Claudia (Harvard University)

Gordon Robert J. (Northwestern University)

Greenstone Michael (Massachusetts Institute of Technology)

Guadalupe Maria (Columbia University)

Guerrieri Veronica (University of Chicago)

Hagerty Kathleen (Northwestern University)

Hamada Robert S. (University of Chicago)

Hansen Lars (University of Chicago)

Harris Milton (University of Chicago)

Hart Oliver (Harvard University)

Hazlett Thomas W. (George Mason University)

Heaton John (University of Chicago)

Heckman James (University of Chicago - Nobel Laureate)

Henderson David R. (Hoover Institution)

Henisz, Witold (University of Pennsylvania)

Hertzberg Andrew (Columbia University)

Hite Gailen (Columbia University)

Hitsch Günter J. (University of Chicago)

Hodrick Robert J. (Columbia University)

Hopenhayn Hugo (UCLA)

Hurst Erik (University of Chicago)

Imrohoroglu Ayse (University of Southern California)

Isakson Hans (University of Northern Iowa)

Israel Ronen (London Business School)

Jaffee Dwight M. (UC Berkeley)

Jagannathan Ravi (Northwestern University)

Jenter Dirk (Stanford University)

Jones Charles M. (Columbia Business School)

Kaboski Joseph P. (Ohio State University)

Kahn Matthew (UCLA)

Kaplan Ethan (Stockholm University)

Karolyi, Andrew (Ohio State University)

Kashyap Anil (University of Chicago)

Keim Donald B (University of Pennsylvania)

Ketkar Suhas L (Vanderbilt University)

Kiesling Lynne (Northwestern University)

Klenow Pete (Stanford University)

Koch Paul (University of Kansas)

Kocherlakota Narayana (University of Minnesota)

Koijen Ralph S.J. (University of Chicago)

Kondo Jiro (Northwestern University)

Korteweg Arthur (Stanford University)

Kortum Samuel (University of Chicago)

Krueger Dirk (University of Pennsylvania)

Ledesma Patricia (Northwestern University)

Lee Lung-fei (Ohio State University)

Leeper Eric M. (Indiana University)

Leuz Christian (University of Chicago)

Levine David I.(UC Berkeley)

Levine David K.(Washington University)

Levy David M. (George Mason University)

Linnainmaa Juhani (University of Chicago)

Lott John R. Jr. (University of Maryland)

Lucas Robert (University of Chicago - Nobel Laureate)

Luttmer Erzo G.J. (University of Minnesota)

Manski Charles F. (Northwestern University)

Martin Ian (Stanford University)

Mayer Christopher (Columbia University)

Mazzeo Michael (Northwestern University)

McDonald Robert (Northwestern University)

Meadow Scott F. (University of Chicago)

Mehra Rajnish (UC Santa Barbara)

Mian Atif (University of Chicago)

Middlebrook Art (University of Chicago)

Miguel Edward (UC Berkeley)

Miravete Eugenio J. (University of Texas at Austin)

Miron Jeffrey (Harvard University)

Moretti Enrico (UC Berkeley)

Moriguchi Chiaki (Northwestern University)

Moro Andrea (Vanderbilt University)

Morse Adair (University of Chicago)

Mortensen Dale T. (Northwestern University)

Mortimer Julie Holland (Harvard University)

Muralidharan Karthik (UC San Diego)

Nanda Dhananjay (University of Miami)

Nevo Aviv (Northwestern University)

Ohanian Lee (UCLA)

Pagliari Joseph (University of Chicago)

Papanikolaou Dimitris (Northwestern University)

Parker Jonathan (Northwestern University)

Paul Evans (Ohio State University)

Pejovich Svetozar (Steve) (Texas A&M University)

Peltzman Sam (University of Chicago)

Perri Fabrizio (University of Minnesota)

Phelan Christopher (University of Minnesota)

Piazzesi Monika (Stanford University)

Piskorski Tomasz (Columbia University)

Rampini Adriano (Duke University)

Reagan Patricia (Ohio State University)

Reich Michael (UC Berkeley)

Reuben Ernesto (Northwestern University)

Roberts Michael (University of Pennsylvania)

Robinson David (Duke University)

Rogers Michele (Northwestern University)

Rotella Elyce (Indiana University)

Ruud Paul (Vassar College)

Safford Sean (University of Chicago)

Sandbu Martin E. (University of Pennsylvania)

Sapienza Paola (Northwestern University)

Savor Pavel (University of Pennsylvania)

Scharfstein David (Harvard University)

Seim Katja (University of Pennsylvania)

Seru Amit (University of Chicago)

Shang-Jin Wei (Columbia University)

Shimer Robert (University of Chicago)

Shore Stephen H. (Johns Hopkins University)

Siegel Ron (Northwestern University)

Smith David C. (University of Virginia)

Smith Vernon L.(Chapman University- Nobel Laureate)

Sorensen Morten (Columbia University)

Spiegel Matthew (Yale University)

Stevenson Betsey (University of Pennsylvania)

Stokey Nancy (University of Chicago)

Strahan Philip (Boston College)

Strebulaev Ilya (Stanford University)

Sufi Amir (University of Chicago)

Tabarrok Alex (George Mason University)

Taylor Alan M. (UC Davis)

Thompson Tim (Northwestern University)

Tschoegl Adrian E. (University of Pennsylvania)

Uhlig Harald (University of Chicago)

Ulrich, Maxim (Columbia University)

Van Buskirk Andrew (University of Chicago)

Veronesi Pietro (University of Chicago)

Vissing-Jorgensen Annette (Northwestern University)

Wacziarg Romain (UCLA)

Weill Pierre-Olivier (UCLA)

Williamson Samuel H. (Miami University)

Witte Mark (Northwestern University)

Wolfers Justin (University of Pennsylvania)

Woutersen Tiemen (Johns Hopkins University)

Zingales Luigi (University of Chicago)

Zitzewitz Eric (Dartmouth College)

Source:

http://faculty.chicagogsb.edu/john.cochrane/research/Papers/mortgage_protest.htm

Other links,

http://www.zogby.com/Soundbites/ReadClips.dbm?ID=18369

http://news.yahoo.com/s/politico/20080921/pl_politico/13689

http://krugman.blogs.nytimes.com/2008/09/24/a-700-billion-slap-in-the-face/#more-906

http://www.washingtonpost.com/wp-dyn/content/article/2008/09/24/AR2008092402799.html?nav=hcmodule

http://georgewashington2.blogspot.com/2008/09/prestigious-group-of-economists-slam.html

Milton Friedman × US Dollar × US Economy × US Financials × US Politics × US Treasury

Box#1 is a clear winner, because you have 100% Freedom of Choice.

Box#4 is a clear loser, because you have 0% Freedom of Choice.

Now, let's take current example of Fed & U.S. Treasury about to spend more than 1,000,000,000,000 (One Trillion) of US tax payers money to bail out big banks & other financials on Wall Street. Sounds familiar???? Box#4.....

God Bless America....

Milton Friedman × US Economy × US Politics

First United States had "Free Market Capitalism".... Then there was an era of "Regulated Market Capitalism" after birth of Federal Reserve.....Now, we have a whole new thing called"Socialism Market Capitalism"..... Socialism for rich..........

What would be the after effects of this Socialism in the country according to Milton Friedman?

Bail Outs × Bailouts × Bill Moyers × Kevin Phillips × US Dollar × US Economy × US Financials × US Politics

Seven Sharks according to Kevin Phillips

Seven Sharks according to Kevin Phillips - Financialization

- Huge built up of U.S. debt

- Home prices collapsing

- Global Commodity inflation building up

- Fraud Government Statistics

- Peak Oil-Shortage of Oil

- Collapsing Dollar

Banks × Ben Bernanke × US Dollar × US Economy × US Financials × US Treasury × US$ Index

Conventional wisdom has it that, as a government fiscalises the contingent liabilities of nationalised banks, the currency of the country in question should depreciate. More generally, banking crises are, very often, accompanied by balance of payments (or currency) crises. The

Popular Thesis on Nationalisation and the Dollar

The notion that nationalisation of banks should lead to currency weakness is popular mainly because it is intuitive. Since nationalisation of banks is ‘not good news’, and runs counter to the principles of capitalism and the free market, some have the visceral reaction to sell the currency in question.

Further, as highlighted by Kaminsky and Reinhart (K&R) (see Graciela Kaminsky and Carmen Reinhart (1999), “The Twin Crises: The Causes of Banking and Balance-of-Payments Problems”, The American Economic Review 89: 3, June), there are many historical examples of ‘twin crises’, whereby banking crises and currency crises occurred simultaneously. The more memorable examples include

This link between banking crises and currency crises is genuine, and the usual dynamics are well-summarised by ex-Governor of the Riksbank (

Moreover, nationalisation of banks will increase the fiscal burden of the government. For a country that already has a large fiscal deficit, this is clearly negative for the interest rate outlook. For one that also has an external deficit, a large public borrowing need, ceteris paribus, should translate into a weaker currency, so the logic goes. At the same time, the central bank may be tempted to ‘monetise’ the debt, or run a monetary stance that is easier than otherwise – again currency-negative.

The Inconvenient Historical Fact

While the arguments above may sound logical and compelling to many, the inconvenient fact is that the historical pattern of how currencies perform before and after nationalisation or bail-outs tells a very different story. Averaged across five episodes of prominent banking crises, the nominal exchange rate tended to fall before nationalisation, but rise thereafter.

The historical pattern suggests that financial markets tend to be forward-looking and try to price in the deterioration in the state of the banking system by selling down the currency and financial sector stocks, but the government is usually not compelled to act until conditions deteriorate significantly. As a result, more often than not, government interventions have coincided with the lows in currency values. In other words, even though K&R’s observation that currency crises often occur simultaneously with banking crises is correct, there is no strong proof that nationalisation leads to further currency weakness.

Other more visible examples are consistent with this link between banking crises and currency crises. The S&L Crisis and its bail-out spanned a protracted period of time. The dollar index did continue to fall from 1986 – the beginning of the S&L Crisis – until 1989 or so. (In 1986, the FSLIC (Federal Savings and Loan Insurance Corporation) – the deposit insurance scheme funded by the thrift industry but guaranteed by the government – first reported being insolvent (incidentally, the main reason why 1986 is remembered as the beginning of the S&L Crisis). The RTC (Resolution Trust Corporation) was established in 1989, and by 2003, the RTC had ‘resolved’ US$394 billion worth of non-performing assets of US savings and loans. (The total cost of the clean-up of the US S&L Crisis reached US$153 billion, in ‘current’ terms equivalent to some 2.6% of US GDP in 1991. This translates to US$375 billion in 2008 dollar terms.) The dollar index essentially moved sideways in the early 1990s. The dollar did falter in 1994/95, but that was attributed more to the inflation scare than to the S&L Crisis. Similarly,

The case of the

In sum, banking crises are unambiguously bad for currencies, but nationalisation per se does not make the situation worse for currencies. In fact, it often marks the low in the currencies.

The

Having said the above, the

The Congressional Budget Office (CBO) released its budget update last week, and predicted that the

Investors will likely see it as key for the next Administration to control spending. However, it is also important for investors to appreciate how sensitive

Bottom Line

Banking crises are bad for currencies, but nationalisation per se does not necessarily make it worse for currencies. In fact, it often marks the low in the currencies. We believe this is the case for the dollar in the current episode. What remains a lingering risk for the dollar over the medium term is the

http://www.morganstanley.com/views/gef/archive/2008/20080919-Fri.html#anchor6931

Commodities × Crude Oil × Currencies × Gold × SPX

Bail Outs × Bailouts × Banks × US Dollar × US Economy × US Financials × US Treasury

US Economy × US Financials

Source: Wall Street Journal

Source: Wall Street JournalFinally WSJ admits that these crisis are worst since Great Depression. I wonder when McCain & Obama will admit that. They both have same policies & they are called "SPENDINGS, BUT NO SAVINGS." Funnily enough current president of United States is saying that "WE ARE JUST HAVING SMALL CORRECTION."

Bail Outs × Bailouts × Banks × FNM × FRE × US Dollar × US Economy × US Financials × US Treasury

AUD/USD × AUDUSD × EUR/USD × Euro × Gold × USD/CHF × USD/JPY

Gold has risen so far near 53$ today, but AUD & EUR have failed to make highs against US Dollar. It is not a divergence of Gold with EUR & AUD to go long against US Dollar. So, be cautious in placing long EUR/USD or AUD/USD or USD/CHF short. Gold is in actual bull mood today due to money supply increased drastically by ECB, RBA & Fed.

Gold has risen so far near 53$ today, but AUD & EUR have failed to make highs against US Dollar. It is not a divergence of Gold with EUR & AUD to go long against US Dollar. So, be cautious in placing long EUR/USD or AUD/USD or USD/CHF short. Gold is in actual bull mood today due to money supply increased drastically by ECB, RBA & Fed.Following charts are Gold against EUR, Gold/AUD, Gold/JPY

Cognitrend Model × EUR/GBP × EUR/JPY × GBP/USD × USD/JPY

Sources:

Sources:Cognitrend

DB-Markets

Gold × Paul Van Eden

In previous article I said increase gold demand from India may boost price of gold in short term, but one of Gold expert in modern market has something simple & different view.

In previous article I said increase gold demand from India may boost price of gold in short term, but one of Gold expert in modern market has something simple & different view.Rest of the article.....